Letter of Credit

Obtaining a properly executable L/C is quite a challenge. So is properly formatting the documents and instructing third parties. In addition, it is also important that the conditions described in the L/C are complied with correctly and in a timely manner.

Are you looking for a reliable and proactive collaboration partner to take care of an L/C without worries?

Would you like to create opportunities for orders in countries where an L/C is simply required or at least very common?

Letters of Credit solutions

We take care of your documents…

- Tailored advice;

- Creation of necessary documentation;

- Contact with involved parties;

- Reviewing all documents;

- The follow-up;

- Legalisation.

Do you want certainty about the delivery and payment of your shipment? We can take care of almost all Letter of Credit related work.

Partners

About Elceco

Informal & quick

A quick brainstorm and immediate clarity so you can continue the activities on which you want to spend your valuable time on: selling your product or service. In the meantime, we take care of your L/C.

With a team of eight enthusiastic and practice-oriented employees, we work from our office in Veghel for our customers, both in the Netherlands and abroad.

Trainingen

We share our knowledge…

We provide training for both potential and existing customers to map and optimize the L/C process together with people from various departments within their companies. We analyze the well-known issues but above all, we focus on how to ensure minimal to no risks in the process.

We also provide workshops on behalf of Evofenedex. We often do this in combination with a bank, in order to highlight the entire process. Are you curious about the possibilities? Please contact us, we will be happy to look at the possibilities together with you.

References

“In view of the complexity of this form of payment, we have fortunately been able to use Elceco’s expertise and services for many years. At Edel Grass we greatly value Elceco’s precision in preparing Letter of Credit documentation as it reflects the superior quality and professionalism we strive for in an highly competitive market.”

“We chooses to fully rely on Elceco in the processing of our L/C’s – and for good reason. Not only do they provide a “good old days” service with no hassle, they are always immediately and directly on hand. It’s really important for us to get the right advice and information during the process.”

“The major advantage of this is that all required documentation can be prepared in advance. Ensuring documents are presented to our bank almost immediately after delivery of goods. This has resulted in not only the quality in documentation being immensely improved, but also having LC payments paid almost two weeks earlier than before!”

Contact with us

Do you have a question about our work or would you like more information about Letters of Credit? Fill in the contact form. Or contact us using the details below.

We think it is important to be easily accessible. Do you have any questions or doubts about something? Or do you just want to spar? Please feel free to contact us by telephone.

Telephone: +31 (0)413 353 131

E-mail address: info@elceco.com

We usually respond within two working days.

Address:

Hoogstraat 5

5462 CW Veghel

The Netherlands

Openings hours:

Monday to Friday from 08.30 to 17.00.

Closed on Saturday and Sunday.

Contactform

Frequently asked questions about the Letter of Credit

The International Chamber of Commerce (ICC) played a pioneering role by establishing the first regulations in the early 1930s and combining them into the first Uniform Customs and Practice for Documentary Credits (UCP). Through this initiative, commercial banks created a voluntary framework to apply these rules in transactions worldwide.

In the early 1970s, SWIFT (Society for Worldwide Interbank Financial Telecommunication) was founded, allowing financial institutions to exchange data electronically and improving cost control. This international communication system between financial institutions provided an efficient way to facilitate transactions and contribute to the further development of international trade practices.

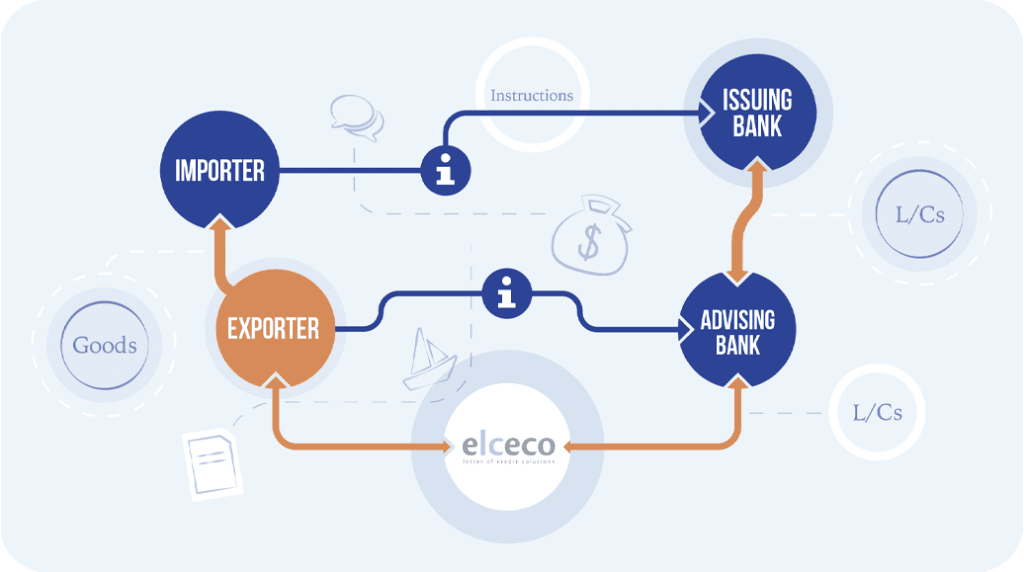

The common thread over the years has remained consistent: international business involving at least four parties, including the buyer, seller, opening bank and advising bank. Changes are especially visible in the receipt of Letters of Credit (L/C) and the processing and presentation of associated documents. In the beginning these were sent physically or via telex, nowadays this is done by e-mail, via integrated systems with the bank, and sometimes still in the classic way by post.

Thanks to advancing computerization, global communication is becoming faster and more efficient, allowing processes to run faster than before. Buyers and sellers can now communicate quickly via email or telephone, which has significantly increased the dynamics of international transactions.

The importer's bank fixes an L/C amount (credit opening) under specific conditions.

The issuing bank then sends the Letter of Credit to the advising bank. The banks use the international means of communication SWIFT for this.

The exporter's bank checks the Letter of Credit. If approved, he sends this to the exporter with an advisory letter. This completes the process at the bank.

The documents must meet the LC conditions in order to obtain an irrevocable commitment to payment.

If the conditions are met and approved by both banks, the payment by the exporter becomes final.